Mega Backdoor Roth Solo 401k: How to Stash $72,000+ Tax-Free

If you are a high earner, the standard Roth IRA limit ($7,000) is a joke. Enter the Mega Backdoor Roth. This is the most powerful retirement strategy in existence, allowing you to shove up to $72,000 (in 2026) into a Roth account in a single year. It involves a complex dance of “After-Tax” contributions and “In-Plan Conversions.” Most free brokers (Fidelity/Vanguard) do not support this. Here is the step-by-step blueprint to unlocking the ultimate tax shelter.

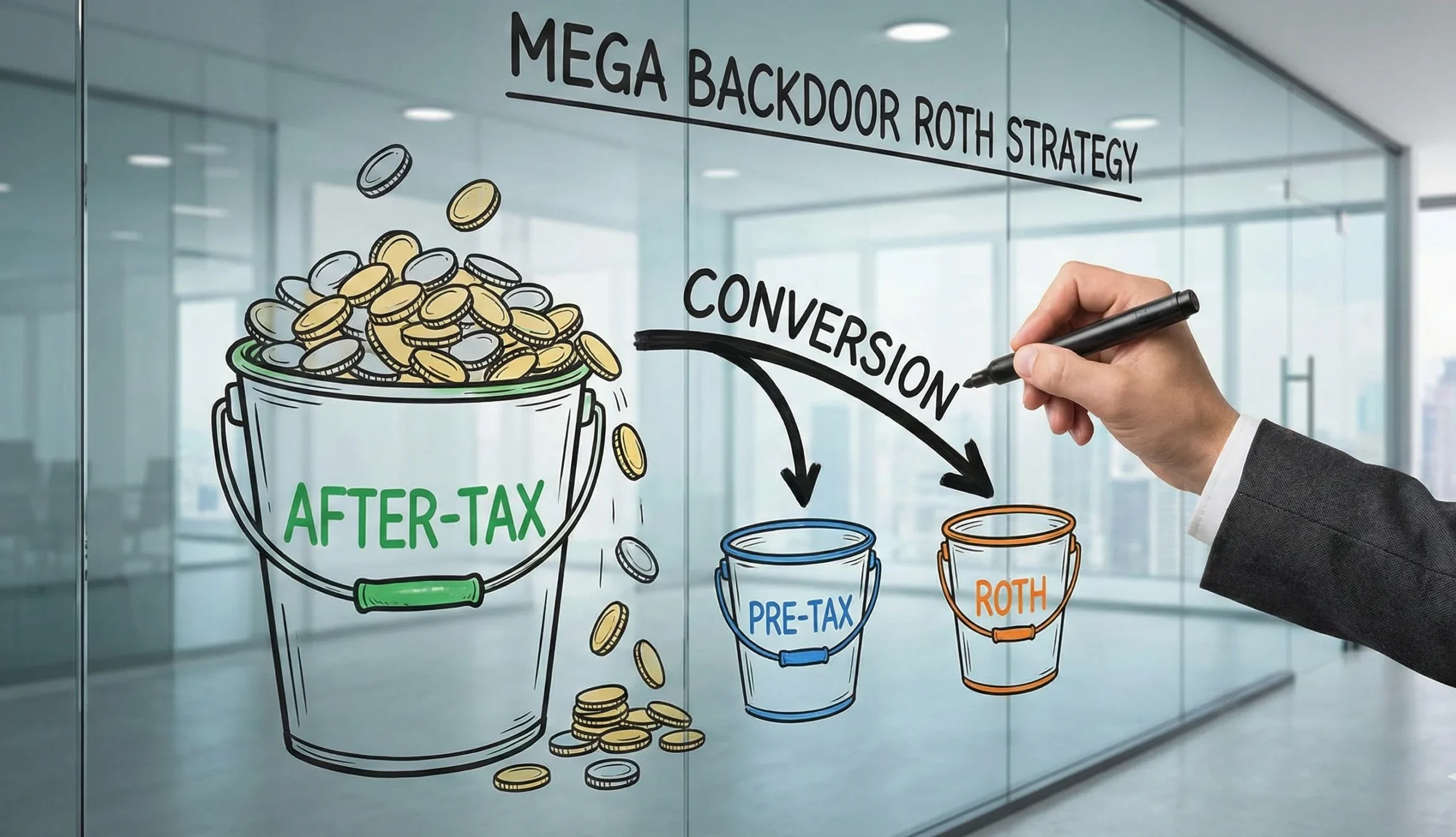

The “Secret Bucket” strategy: Fill the After-Tax bucket, then convert it to Roth immediately.

1. The Secret “Third Bucket”

Most people only know two buckets. The magic lies in the third one.

Usually, this “Remaining Space” is wasted. With Mega Backdoor, you fill this space with “Voluntary After-Tax” money and convert it to Roth.

2. How to Execute the Strategy

Speed is critical. You do not want the After-Tax money to grow before conversion.

- Step 1: Contribute. Deposit funds into the “Voluntary After-Tax” sub-account of your Solo 401k. (Note: This is different from a Roth contribution).

- Step 2: Convert. Immediately perform an “In-Plan Roth Rollover.” Move the funds from the After-Tax bucket to the Roth bucket.

- Step 3: File. You will receive a Form 1099-R. Since you already paid taxes on the money (After-Tax), the conversion tax is usually $0 (assuming zero growth).

- Result: The money is now in the Roth bucket, growing tax-free forever.

3. Why Fidelity/Vanguard Won’t Work

You need specific features that “Free” plans remove to simplify administration.

| Feature Required | Standard Broker Plan | Custom Plan (Paid) |

|---|---|---|

| After-Tax Contributions | NO | YES |

| In-Plan Roth Rollover | NO | YES |

| Mega Backdoor Capable? | Impossible | Fully Enabled |

4. Is This Strategy for You?

This is a Ferrari. Don’t buy it if you need a minivan.

- High Earners: You already maxed out the $24,500 limit and have extra cash.

- Super Savers: You want to save >$50k/year for retirement.

- Tax Haters: You believe taxes will go up in the future (Roth bet).

- Low Margins: You struggle to save even $20k.

- Simplicity Seeker: You hate extra tax forms (1099-R).

- Standard Plan: You refuse to pay setup fees ($500+) for a custom plan.